iowa inheritance tax rates 2020

Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance. 150001-and more has an Iowa inheritance tax rate of.

Iowa Legislature Passes Bill To Cut Income Inheritance And Property Taxes

If the net value of the decedents estate is less than 25000 then no tax is applied.

. Land protection may reduce the value of your land which in turn reduces the value of your estate and may reduce your federal estate tax and state inheritance tax. 036 on the first 1539 of taxable income. 75001-100000 has an Iowa inheritance tax rate of 8.

That is worse than Iowas top inheritance tax rate of 15. It is most common for Iowa inheritance tax to be due when estate shares are left to non-lineal relatives of the decedent such as brothers sisters nieces nephews aunts uncles or cousins. Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20.

How much is the inheritance tax in Iowa. ESTATEGIFT TAX RATE SCHEDULE. The following Inheritance Tax rates will apply to a decedents beneficiary who is a.

Report Fraud. Especially if your total assets. Aunts uncles cousins nieces and nephews of the decedent.

Up to 25 cash back Spouses children and parents of a deceased person are exempt from Iowa inheritance tax while other inheritors might have to pay. 100001-150000 has an Iowa inheritance tax rate of 9. How do I avoid inheritance tax in Iowa.

Track or File Rent Reimbursement. Grow Your Legal Practice. Iowa collects income taxes from its residents at the following rates.

Bracket Tax Is This Amount Plus This Percentage Of the Amount Over 0 to 2600 0 plus 10 0 2600 to 9450 260 plus 24 2600 9450. For persons dying in the year 2022 the Iowa inheritance tax will. Property passing to parents grandparents great-grandparents and other lineal ascendants is.

What is the federal inheritance tax rate for 2020. For decedents dying on or after January 1 202 but before January 1 2022 the 3applicable tax rates listed in Iowa Code section 450101-4 are reduced by 40. For more information on exempt beneficiaries check out Iowa Inheritance Tax Law Explained.

Inheritance Tax Rates Schedule. How do I avoid inheritance tax in Iowa. The applicable tax rates.

There are a number of categories. That is worse than Iowas top inheritance tax rate of 15. Register for a Permit.

If instead you are a sibling or other non-linear ancestor then you are subject to. Schedule B beneficiaries include siblings half. Property passing to parents grandparents great-grandparents and other lineal ascendants is.

What is the inheritance tax 2020. As mentioned inheritance tax rates vary from state to state. Iowa Inheritance and Gift Tax.

0-50K has an Iowa inheritance tax rate of. Change or Cancel a Permit. Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty percent.

A summary of the different categories is as follows. It has an inheritance tax with a top tax rate of 18. One example of this is in Iowa where an inheritance with a value of 25000 or less isnt taxable.

072 on taxable income between 1540 and 3078. Adopted and Filed Rules. By Staff Writer Last.

1 INHERITANCETAX4501 CHAPTER450 INHERITANCETAX Thischapterisinapplicableandtheinheritancetaxshallnotbeimposedonthe.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Estate And Inheritance Taxes Around The World Tax Foundation

State By State Estate And Inheritance Tax Rates Everplans

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Gift Tax Does This Exist At The State Level In New York

Recent Changes To Iowa Estate Tax 2022

Iowa Inheritance Tax Law Explained

Does Your State Have An Estate Or Inheritance Tax

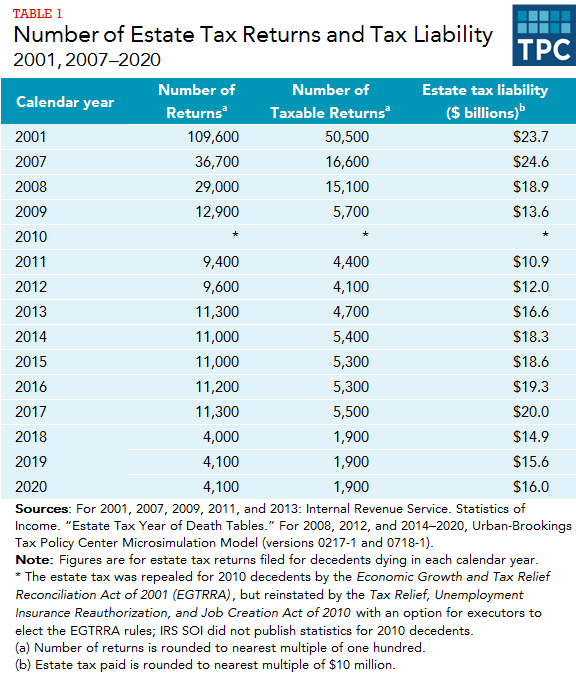

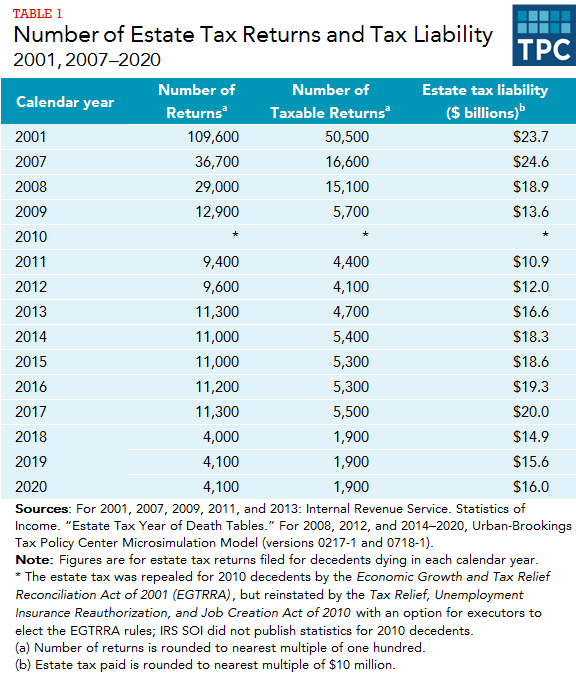

How Many People Pay The Estate Tax Tax Policy Center

Estate And Inheritance Taxes Around The World Tax Foundation

Iowa Inheritance Tax Rates Fill Online Printable Fillable Blank Pdffiller

State By State Estate And Inheritance Tax Rates Everplans

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)